Increasing ambitions for financial security in Southern Europe

European Money Week 2021: Intrum finds that the pandemic is having a positive side-effect: it’s increasing European consumers’ ambitions for financial security.

The European Money Week 2021 (from 22nd to 26th of March) marks the annual initiative to promote financial literacy among European consumers.

This year’s events are taking place after a turbulent year for the pandemic-hit European economy. But against the backdrop of economic uncertainty, there are encouraging signs in how Europeans are approaching their personal finances.

The ECPR 2020 finds that there’s a particular interest from Southern European consumers in achieving a healthier financial situation.Insights from the European Consumer Payment Report 2020

The latest European Consumer Payment Report (ECPR) from Intrum finds that many individuals want to achieve financial security and improve their financial education:

- Nearly half (47%) of all respondents to the report indicate that financial security has become a key personal goal; and,

- 40% are actively improving their financial literacy to prepare for economic uncertainty.

In Greece

Financial literacy is a silver lining, up four places on the pillar. Greek consumers scored second on the survey’s financial calculation test. Moreover, around half of respondents (51%) say they are taking steps to improve their financial literacy to prepare for Covid-19 uncertainty. In Greece, six out of ten say that since the beginning of the pandemic, improving financial security is now one of the top priorities. At the same time, five out of ten seek to enhance their knowledge of financial management. The main sources of financial education of respondents in 2020 are the Internet (55%), school (49%) and parents (45%), while for 2019 were parents (64%), school (49%) and third the Internet (38%).

Why personal financial literacy has become so important

A key reason for European consumers’ growing sense of financial awareness is the sudden economic instability that arose from the Covid-19 pandemic in early 2020.

The economic implications of the pandemic have impacted European’s income and spending habits, and accelerated the financial differences between consumer groups:

Individuals with lower incomes tend to have been more affected by income losses and unemployment, as a result of the restrictions. This is most evident in Southern Europe, where 49% of Greek consumers and 47% of Italian and Portuguese consumers reported that their income had decreased as a result of the pandemic. On the other hand, consumers who have been able to keep their jobs and work from home have found themselves having better financial margins than before the outbreak of the pandemic.

The pandemic’s economic impact has therefore been a salutary reminder of the importance of sound personal finances.

Financial awareness on the rise in Southern Europe

The ECPR 2020 finds that there’s a particular interest from Southern European consumers in achieving a healthier financial situation:

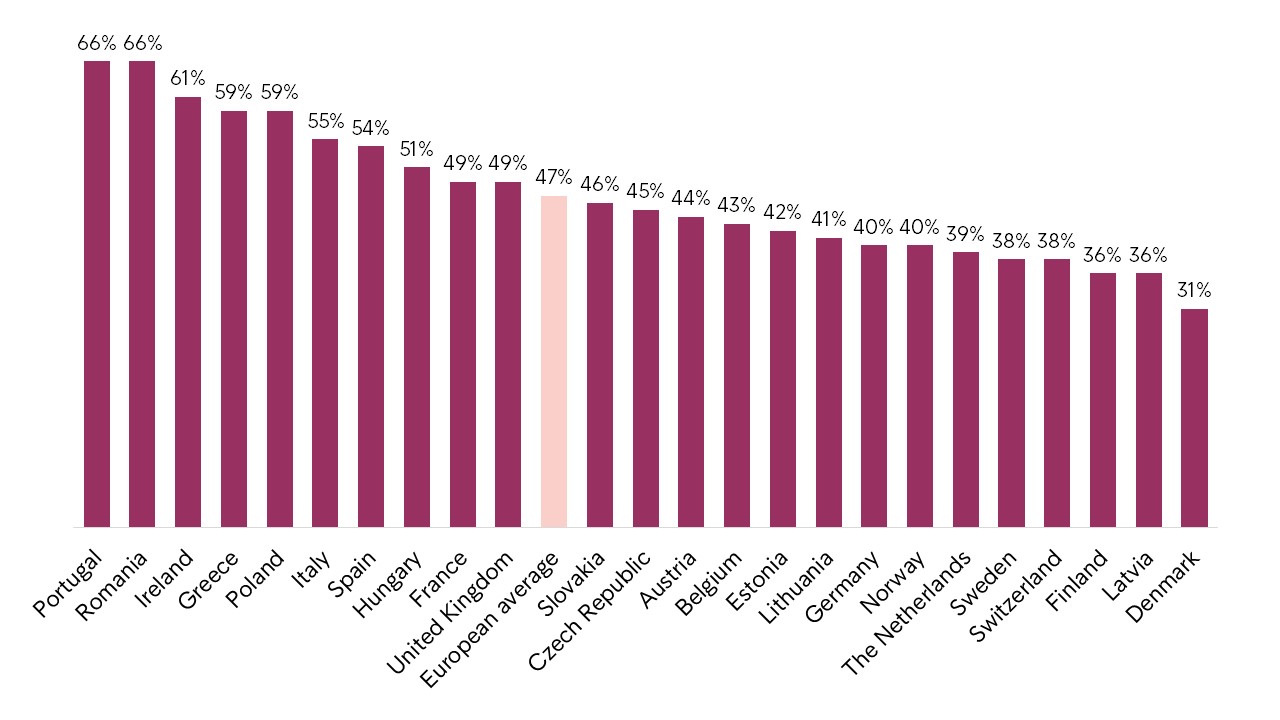

- More than six in ten (66%) of Portuguese and Romanian consumers say that improving their financial security has become one of their top priorities since the Covid-19 crisis began.

- From Northern Europe, just 36% of Finns and 31% of Danes regard this issue as a priority

Q: Since the Covid-19 crisis began, improving my financial security has become one of my top priorities (agree, split country by country):

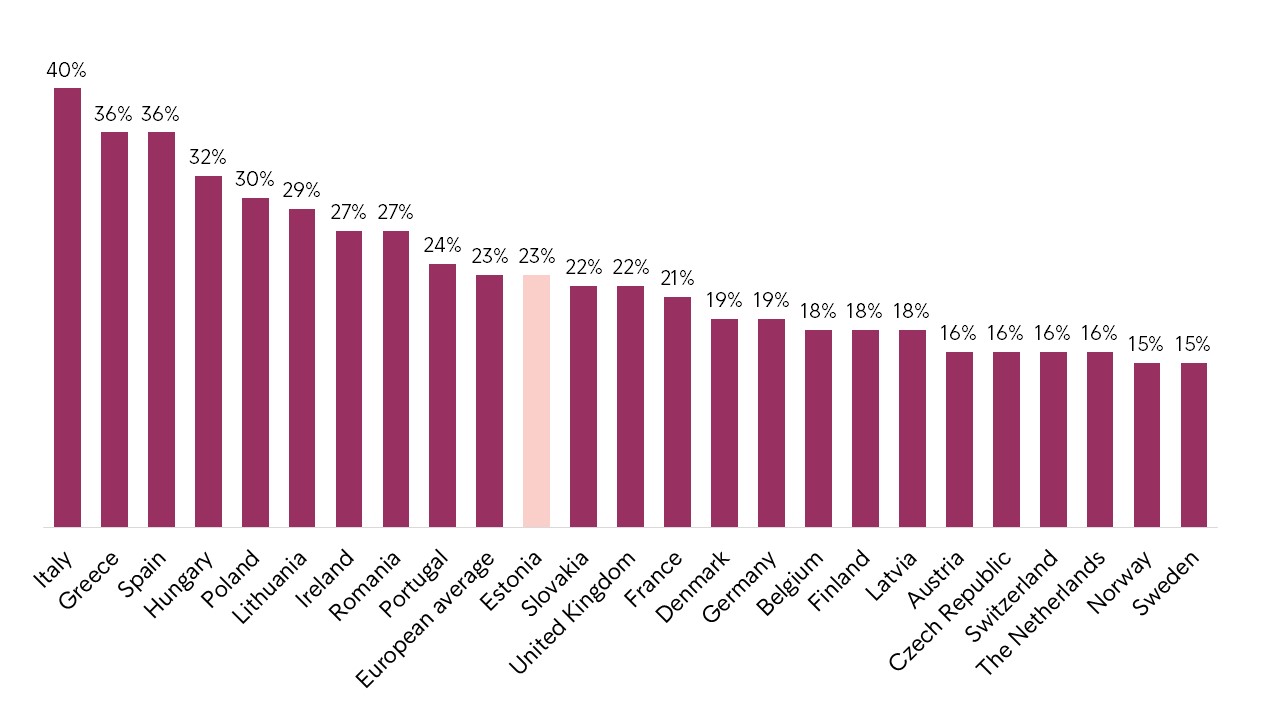

The increasing interest in improving financial security may be correlated with Southern Europeans reporting that they do not have sufficient financial education to manage their personal finances.

Four in ten (40%) Italian consumers and 36% of Greek and Spanish consumers say they lack financial literacy. The European average here is 23% and in Norway and Sweden, the figure is just 15%.

Q: I do not feel I received sufficient financial education to manage by day-to-day finances, and I often seek external advice (agree, split country by country):

In Greece

Financial literacy is a silver lining, up four places on the pillar. Greek consumers scored second on the survey’s financial calculation test. Moreover, around half of respondents (51%) say they are taking steps to improve their financial literacy to prepare for Covid-19 uncertainty. In Greece, six out of ten say that since the beginning of the pandemic, improving financial security is now one of the top priorities. At the same time, five out of ten seek to enhance their knowledge of financial management. The main sources of financial education of respondents in 2020 are the Internet (55%), school (49%) and parents (45%), while for 2019 were parents (64%), school (49%) and third the Internet (38%).

A sound economy is more important than ever

The future is uncertain and strongly depends on the development of the pandemic. However, everyday life will gradually return a new normal. When restrictions are lifted, it will be an important task to help those most financially affected by the pandemic.