Gender gap in financial literacy

European Money Week 2021: The gender gap in financial literacy is a persistent problem for European societies. Our latest survey finds that women are less likely than men to feel confident about financial matters

Financial literacy is the ability to understand how money works: the set of skills and knowledge that allow us to make informed and effective financial decisions. Reduced incomes, job uncertainty and the prospect of a global recession mean that now, more than ever, consumers should be equipped with the knowledge they need to manage their finances.

Financial literacy is the ability to understand how money works: the set of skills and knowledge that allow us to make informed and effective financial decisions. Reduced incomes, job uncertainty and the prospect of a global recession mean that now, more than ever, consumers should be equipped with the knowledge they need to manage their finances.Insights from the European Consumer Payment Report 2020

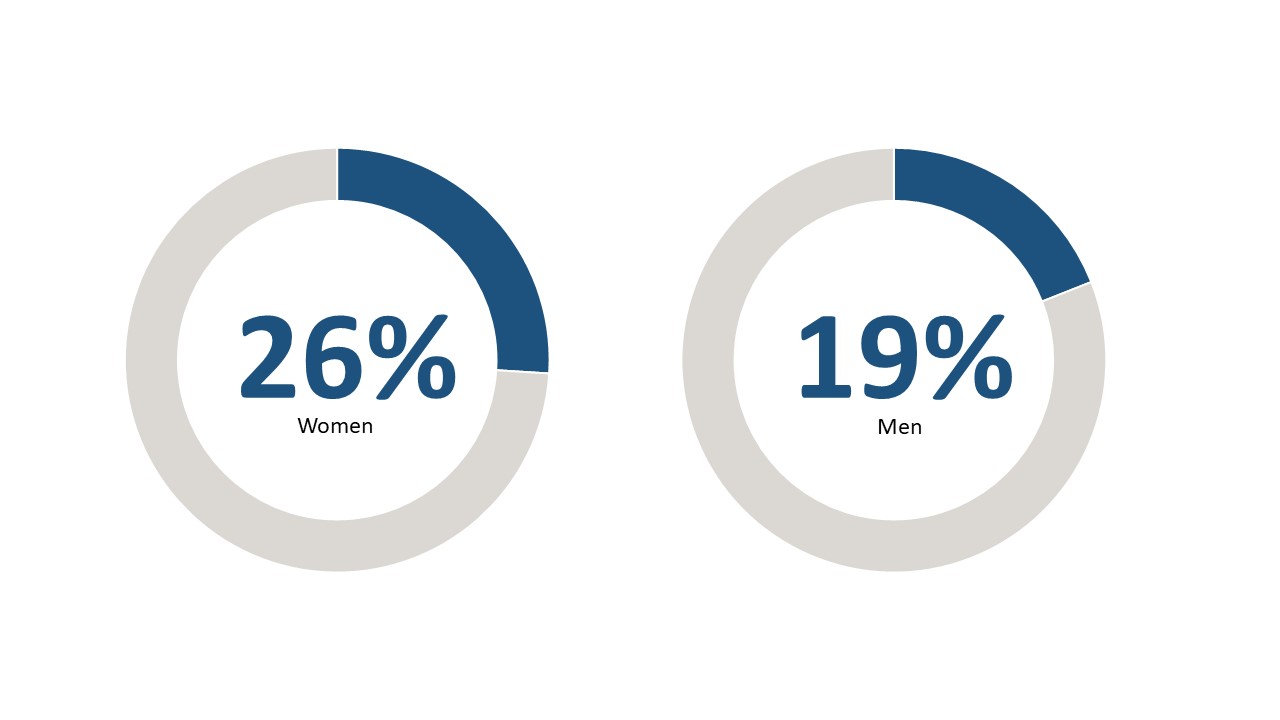

The European Consumer Payment Report 2020 identifies a clear gender divide in attitudes when it comes to personal finances; more than one in four (26%) of European women feel they have enough financial education to manage their personal finances, compared to 19% of European men.

Q: I do not feel I received sufficient financial education to manage by day-to-day finances, and I often seek external advice (agree, split by gender):

This disparity reflects a wider inequality. The European Parliament estimated that women in the EU earn on average about 15% less per hour than men. They are also relatively under-represented in the labour market: almost 30% of women in the EU work part time, and women are more likely to stop working to take care of children and relatives

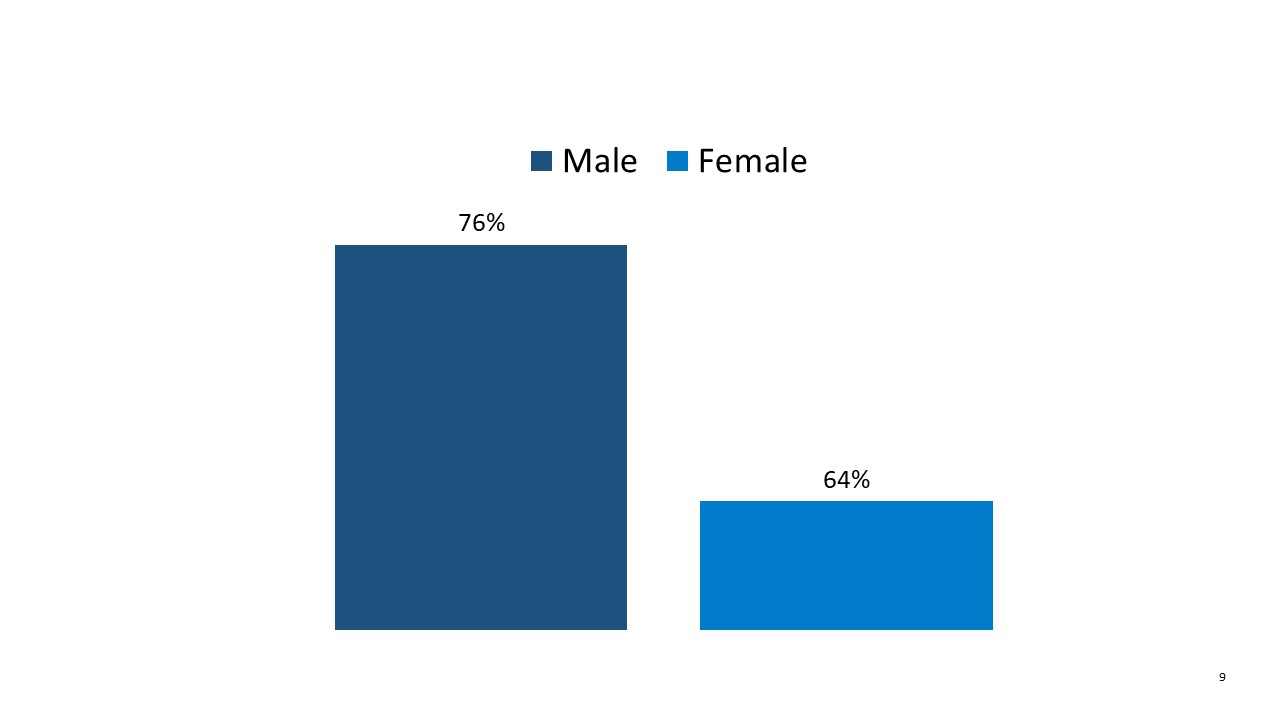

The lack of confidence might be rooted in the ability to handle money. When we tested 24,000 consumers in our survey about a simple calculation of interest, we found a significant gap between genders; only 64% of female respondents answered correctly compared to 76% of male respondents.

“If you had €200 in a savings account earning 2% interest a year, how much would you have in the account after five years (assuming you didn’t pay any new money into the account or make any withdrawals)?” Proportion of people answering correctly:

Men use online sources for financial education

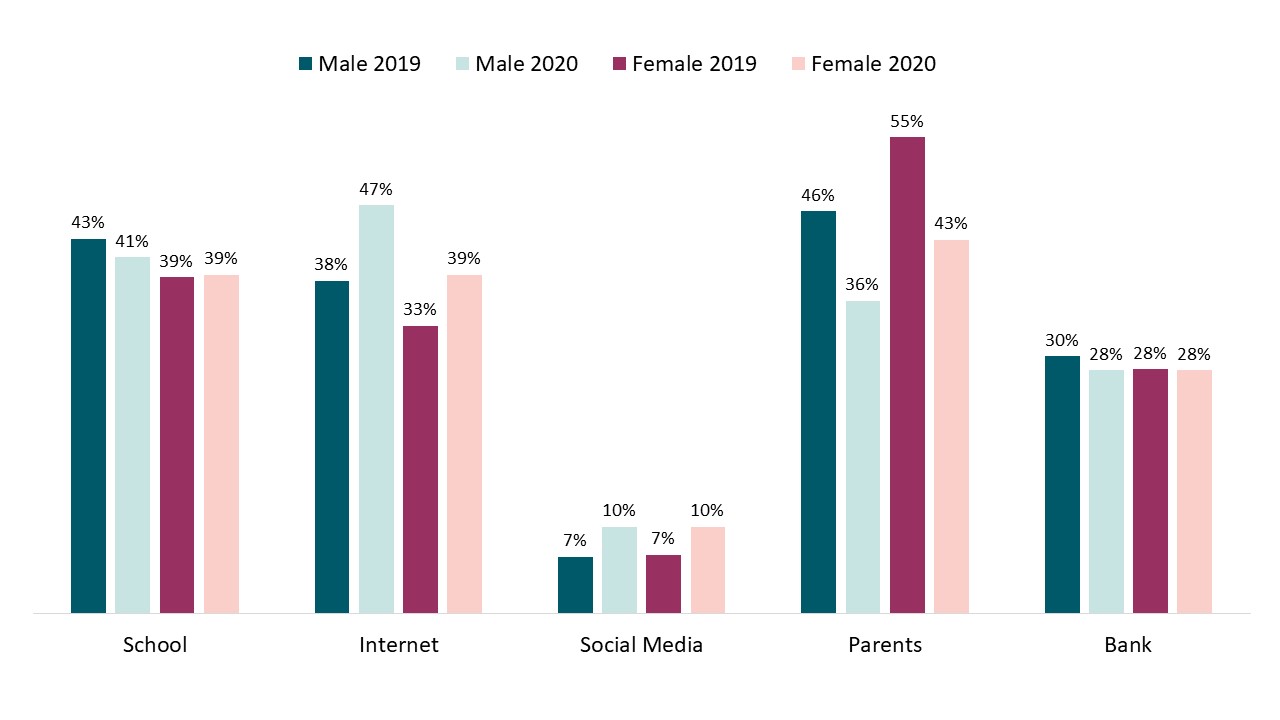

Intrum’s 2020 European Consumer Payment Report shows a significant increase in the role of the internet with regard to financial education, compared with just a year ago.

We see a notable shift in both genders when it comes to the source of financial education, moving from parents as primary source to internet and social media as main source of information. Close to half (47%) of men are cited as using the internet as their primary source, up from 38% in 2020. 39% of women say they do the same in 2020.

Q: Over the course of your lifetime, what have been your primary sources of financial education? (top 5 answers, 2019 vs 2020, split by gender)

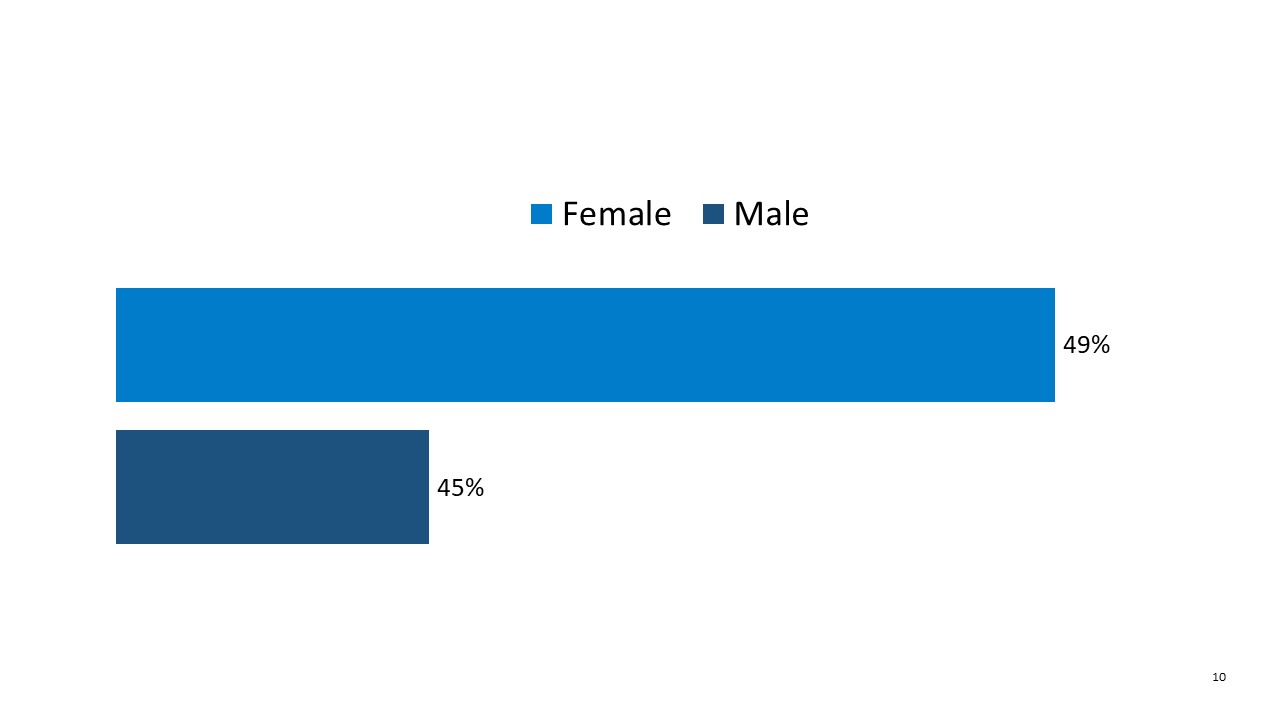

European women are taking action to mitigate the financial risks due to the ongoing pandemic. Close to half (49%) of female respondents said that improving their financial security has become a top priority, compared to 45% of male respondents.

Q: Since the Covid-19 crisis began, improving my financial security has become one of my top priorities (agree, split on gender):

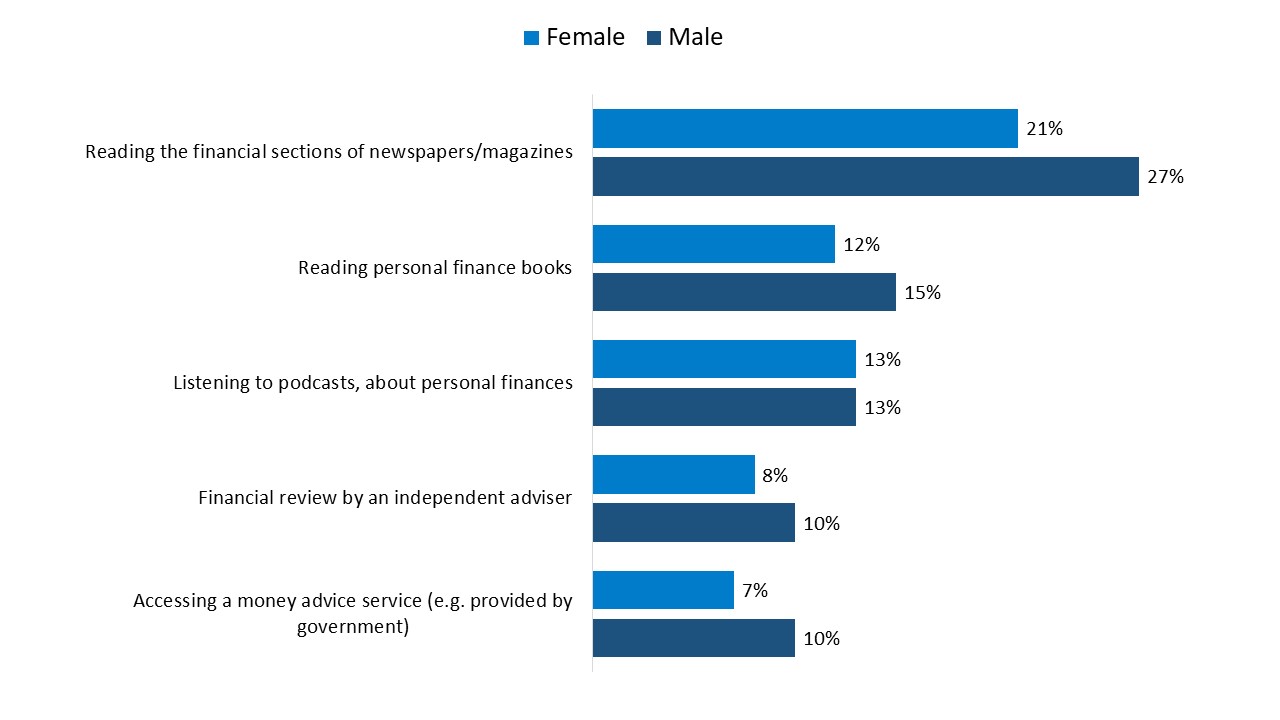

When asked what steps they have been taking to improve their financial literacy since the beginning of the pandemic, a majority of both genders said they read the financial section of newspapers; reading books and listening to podcasts were the next most popular methods.

Q: Which of the following steps have you taken, if any, to improve your financial literacy since the beginning of the Covid-19 crisis? (split by gender):

Financial education is key to meet the challenges posed by the pandemic

A key finding from the ECPR 2020 is the increasing stress felt among European consumers regarding their personal finances. Better access to financial education at different stages in life has a crucial role to play.