Economic uncertainty is driving consumers to improve financial literacy

As consumers respond to the challenges posed by Covid-19, we see individuals striving to achieve greater control of their finances by expanding their knowledge of financial matters.

Financial literacy is the ability to understand how money works: the set of skills and knowledge that allow us to make informed and effective financial decisions.

Reduced incomes, job uncertainty and the prospect of a global recession mean that now, more than ever, consumers should be equipped with the knowledge they need to manage their finances.

Covid-19 is driving new interest

Around half of all respondents (47 per cent) indicate that financial security has become a top ambition for them, while 40 per cent are actively improving their financial literacy to prepare for economic uncertainty.

There is particular interest in improving financial security among at-risk countries in Southern Europe. Two in three (66 per cent) Portuguese consumers say that, since the Covid-19 crisis began, improving their financial security has become one of their top priorities.

Consumers embrace online sources

The influence of banks on financial literacy is waning among digitally savvy younger consumers, who are less likely than older groups to have received their financial education from these institutions.

Four in 10 seniors (65+) say their bank provided their main financial education, compared with 28 per cent of all respondents who say the same, which reflects the lack of choice that many faced in the decades before the internet.

52% of consumers under the age of 40 say internet has been their principal source of information.Insights from the European Consumer Payment Report 2020

Among all respondents to our survey, the internet has become the most popular source of financial education, with 43 per cent of consumers (rising to 52 per cent of those under 40, including Gen Z and Millennials) saying it has been a principal source of information.

As might be expected from a digital leader, Estonians cite the internet as their primary source of financial education (54 per cent) compared with the European average of 43 per cent. Four in ten (43 per cent) also point to a strong grounding at school, slightly above the 40 per cent European average.

Three in 10 say financial literacy would improve their relationships

As well as helping individuals plan for the future and make better decisions, financial literacy appears to have a strong influence on personal relationships.

Three in 10 (29 per cent) say it would be better for their relationship if they and their partner were more capable at managing their personal finances. This rises to around four in 10 among consumers in Southern European countries such as Greece, Spain and Portugal, where the macroeconomic backdrop is also more strained.

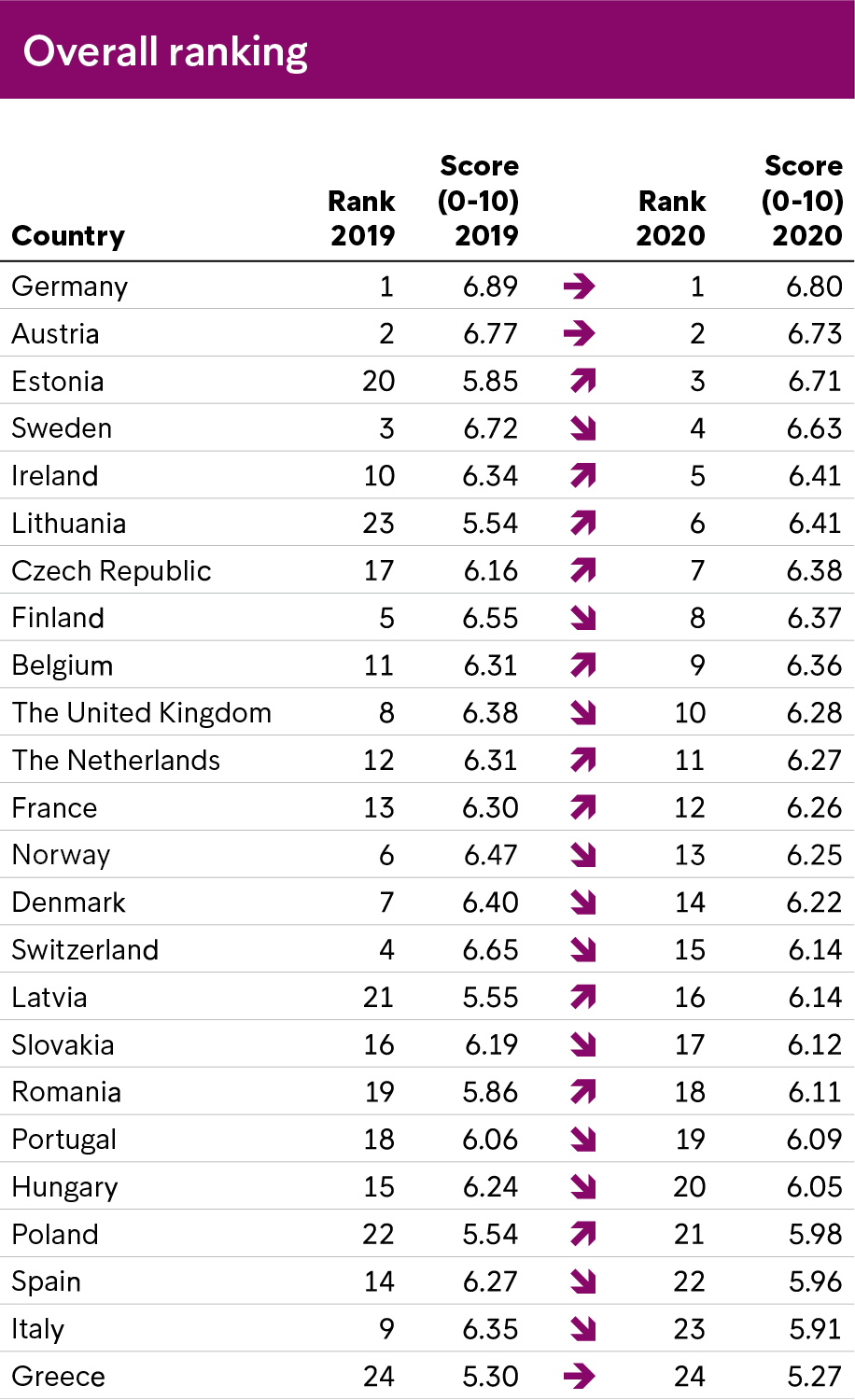

Finland still rank on top in Europe while Baltic countries takes a leap

According to the Intrum Financial Wellbeing Barometer, Finnish consumers are most advanced in their financial literacy.

The Intrum Financial Wellbeing Barometer presents an overall financial wellbeing score for each country based on three pillars; Ability to pay bills, Saving for the future and Financial literacy. Read more about the overall results of the Intrum Financial Wellbeing Barometer here.

The financial literacy pillar measures the extent to which consumers understand basic financial terms and calculations relating to savings. Our survey suggests that the fallout from Covid-19 has motivated consumers across Europe to improve their financial literacy the past year.

As mentioned in the overall rankings, the Baltic countries have made some of the most impressive gains in financial literacy over the last year. All three Baltic countries have improved in their ability to define key financial terms, whereas Lithuanian respondents have improved most in their ability to calculate the annual rate of growth in a hypothetical savings account (the financial calculation indicator).

In Greece

Financial literacy is a silver lining, up four places on the pillar. Greek consumers scored second on the survey’s financial calculation test. Moreover, around half of respondents (51%) say they are taking steps to improve their financial literacy to prepare for Covid-19 uncertainty. In Greece, six out of ten say that since the beginning of the pandemic, improving financial security is now one of the top priorities. At the same time, five out of ten seek to enhance their knowledge of financial management. The main sources of financial education of respondents in 2020 are the Internet (55%), school (49%) and parents (45%), while for 2019 were parents (64%), school (49%) and third the Internet (38%).

Access to financial education is key

Access to financial education and possessing skills to make wise financial decisions will be key for individuals to meet the challenges posed by the Covid-19 pandemic.

Founded in 1923, we at Intrum have a long history in helping customers to navigate financial downturns. In today’s challenging environment, we aim to empower businesses and consumers alike with our expertise and solutions. In this way, we will help to rebuild sound economies across Europe.

About the report:

The European Consumer Payment Report is based on an external survey of 24,198 consumers in 24 European countries. The field work took place between 28th of August and 5th of October 2020.